How the “Buy, Borrow, Die” Strategy Builds Wealth and Avoids Taxes

How the “Buy, Borrow, Die” Strategy Builds Wealth and Avoids Taxes

What if you could access millions in wealth without selling your assets—or paying a dime in taxes? That’s exactly what the wealthiest Americans have been doing for decades using a strategy called Buy, Borrow, Die.

While it may sound like a clickbait slogan, this approach is a time-tested way to build and preserve wealth. And despite what you may think, it’s not just for billionaires. Everyday investors use the same strategy with brokerage accounts, real estate, and small businesses.

In this article, we’ll break down how Buy, Borrow, Die works, why it’s so effective, and how you can start using it to grow your wealth while minimizing taxes—legally.

Step 1: Buy Appreciating, Income-Producing Assets

The first step is buying assets you understand—those that generate income and have the potential to appreciate over time.

Think:

- Investment real estate (rental properties)

- Stock Portfolios (stocks, ETFs, mutual funds)

- Privately held businesses (your own company or private equity)

These assets grow over time and, in many cases, generate cash flow along the way via rental income or dividends. That means they not only increase your net worth, they also create ongoing income—which sets the stage for the “borrow” part of the strategy.

Key Rule: Don’t buy and sell. Buy and hold. That’s where real wealth is built.

Step 2: Borrow Against the Assets (Without Selling)

This is where most of the tax planning magic happens.

Rather than selling your appreciated assets—and triggering capital gains tax—you borrow against them. Equity in assets accessed via a loan isn’t taxable income. That means you can unlock your wealth selling assets or owing the IRS.

Two Common Borrowing Scenarios for Building Wealth

- Brokerage Account

Let’s say you’ve built a $1M stock portfolio. You need $200K for a large expense—could be taxes, a business opportunity, or even a major life event.

- Option A: Sell investments → You trigger capital gains tax. Depending on your bracket and state, you could lose $50K or more just in taxes.

- Option B: Borrow against your portfolio → You pay no tax. Your portfolio stays fully invested and continues to grow.

This strategy is called securities-based lending. With a securities-backed line of credit, firms like JP Morgan, Wells Fargo, or your private bank will lend you 70–90% of your portfolio’s value, using your stocks, bonds, or mutual funds as collateral.

- Stay invested

- Access low-interest liquidity

- Avoid triggering capital gains tax

Bottom line: You get the cash you need—without dismantling your long-term investment plan.

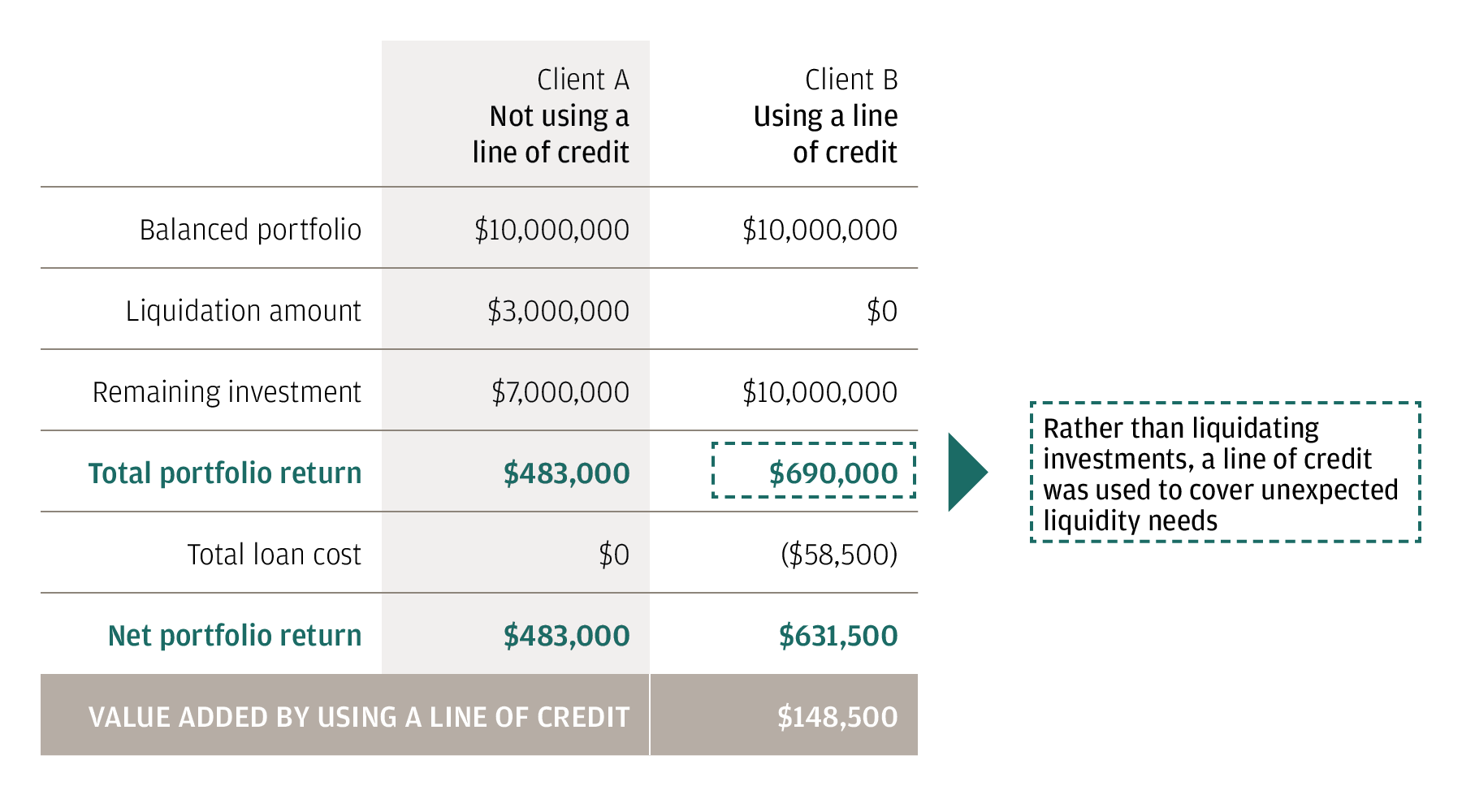

📉 See chart above: Client B uses a line of credit instead of liquidating assets. They keep their portfolio fully invested, pay minimal loan interest, and walk away with $148,500 more in net returns.

- Investment Real Estate (Cash-Out Refi)

Own a $1M rental property with equity? Use a cash-out refinance to pull $700K without selling. You still own the asset, still collect rent, and you pay no tax on the money you borrowed.

Step 3: Die (and Pass It on Tax-Free)

Let’s be honest—this is the least fun part of the strategy. But it’s one of the most powerful.

When you die, your heirs receive a step-up in basis. That means all of the appreciation during your lifetime—stocks, real estate, businesses—is wiped clean from a tax standpoint.

Let’s say:

- You bought a stock for $100K

- It’s worth $1M when you pass away

- You borrowed $700K against it during your lifetime

Your heirs inherit the asset at a $1M stepped up basis – which means they can sell it the next day for $1M and pay zero capital gains tax. The $700K loan is paid off, and the rest goes to them tax-free. In the end neither you nor your heirs paid capital gains tax.

Why This Strategy Works (Even If You’re Not a Billionaire)

You don’t need a $10M portfolio to use this. In fact, many investors use this strategy with:

- $250K brokerage accounts

- A single rental property

- Business equity

Here’s why it works:

- Loans are not taxable

- Assets keep appreciating

- You avoid selling (and shrinking) your net worth

- Your heirs benefit from a tax-free step-up in basis

Congress has taken notice and bills have been introduced to limit or eliminate the step-up in basis. There have even been bills intended to tax you when you access equity in an asset via a loan. Those bills have all failed. For now, Buy, Borrow, Die remains one of the most powerful—and legal—wealth-building and tax-saving strategies available.

Key Takeaways

- Buy assets that appreciate and produce income

- Don’t sell—borrow

- Loans are not taxable income

- Borrowing allows you to enjoy your wealth without shrinking your net worth

- Your heirs can inherit assets tax-free with a step-up in basis

- This strategy works for real estate, stock portfolios, and even businesses

Ready to Build Your Wealth—Step by Step?

The Buy, Borrow, Die strategy is just one piece of a bigger picture. If you want to know where to start and what to do next, download Mat’s guide on the Ideal Order of Investing.

Whether you’re just getting started or ready to expand into real estate, Roth IRAs, or alternative assets—this is the roadmap.

👉 Download the Free Guide: The Ideal Order of Investing

Take control of your financial future—one smart move at a time.